Medical Devices Market Size to Reach USD 886.80 Billion by 2032 | Medical Devices Industry CAGR 6.3% (2025-2032)

Leading companies in the medical devices market include Johnson & Johnson Services, Inc., Stryker, Abbott, BD, Cardinal Health, Medtronic, & more.

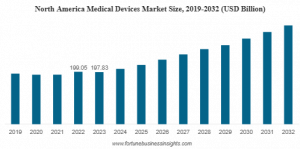

NY, UNITED STATES, April 4, 2025 /EINPresswire.com/ -- The global medical devices market was valued at USD 518.46 billion in 2023 and is expected to grow from USD 542.21 billion in 2024 to USD 886.80 billion by 2032, reflecting a CAGR of 6.3% over the forecast period. North America led the medical devices market in 2023, holding a 38.16% share. Additionally, the U.S. medical device market is expected to experience substantial growth, reaching approximately USD 314.96 billion by 2032, fueled by a strong innovation pipeline and rising R&D investments from industry players.Medical devices encompass a wide range of single-use instruments, equipment, materials, and other essential products used in healthcare procedures. These include surgical implants, diagnostic devices, monitoring equipment, wound care products, and more. The growing demand for medical devices is driven by the increasing number of medical treatments worldwide, particularly in fields like surgery and diagnostics.

Fortune Business Insights™ presents this data in a report titled "Medical Devices Industry Share, Size, Global Report, and Forecast, 2025-2032.

𝐆𝐞𝐭 𝐚 𝐅𝐫𝐞𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐏𝐃𝐅: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/medical-devices-market-100085

Impact of U.S. Tariffs on Medical Devices

The U.S. administration's imposition of new tariffs on imported medical devices, including pacemakers and X-ray machines, has led to notable declines in medical device stocks. Companies such as Boston Scientific, Medtronic, Siemens Healthineers, Cardinal Health, and Masimo have experienced early trading declines. Wells Fargo estimates that annual earnings per share for companies like Bausch & Lomb could decrease by up to 13.8%

Exclusion of Pharmaceuticals from Tariffs

While medical devices are affected by the new tariffs, pharmaceuticals have been temporarily excluded, providing relief to drug manufacturers. For instance, Australian pharmaceutical and biotech companies have largely avoided the adverse effects of these tariffs, as pharmaceutical products have been exempted from the 10% tariff imposition.

𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐜𝐨𝐩𝐞:

♦ Market Size Value in 2024: USD 542.21 Billion

♦ Market Size Value in 2032: USD 886.80 Billion

♦ Growth Rate: CAGR of 6.3% (2025-2032)

♦ Base Year: 2023

♦ Historical Data: 2019-2022

♦ Years Considered for the Study: 2019-2032

♦ No. of Report Pages: 180

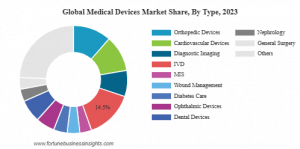

𝗦𝗲𝗴𝗺𝗲𝗻𝘁𝘀 𝗖𝗼𝘃𝗲𝗿𝗲𝗱: By type (including orthopedic devices, cardiovascular devices, diagnostic imaging, in vitro diagnostics (IVD), minimally invasive surgery (MIS), wound management, diabetes care, ophthalmic devices, dental devices, nephrology equipment, general surgery tools & others), By End-User (Hospitals, ASC & others), By Region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa).

𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐚𝐭𝐢𝐨𝐧 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬:

By Product Type: The in-vitro diagnostics (IVD) segment led the market in 2023 due to rising diagnostic tests, while diabetes care is expected to grow fastest with increased blood glucose monitor adoption. Other segments, including surgery, dental, ophthalmic, and nephrology, are also expanding due to technological advancements and rising patient demand.

By End-user: The hospitals & ASCs segment dominated the medical devices market in 2023 due to rising patient visits and increasing healthcare expenditures, leading to facility expansion. Clinics and other segments are also expected to grow, driven by patient preference for specialized and efficient care.

𝐑𝐞𝐩𝐨𝐫𝐭 𝐂𝐨𝐯𝐞𝐫𝐚𝐠𝐞:

The market research report offers an in-depth analysis, covering key companies, products, and end-users. It also provides insights into market trends, industry developments, and factors driving market growth in recent years.

𝐁𝐫𝐨𝐰𝐬𝐞 𝐃𝐞𝐭𝐚𝐢𝐥𝐞𝐝 𝐒𝐮𝐦𝐦𝐚𝐫𝐲 𝐨𝐟 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐰𝐢𝐭𝐡 𝐓𝐎𝐂:

https://www.fortunebusinessinsights.com/industry-reports/toc/medical-devices-market-100085

𝐋𝐈𝐒𝐓 𝐎𝐅 𝐓𝐎𝐏 𝐊𝐄𝐘 𝐂𝐎𝐌𝐏𝐀𝐍𝐈𝐄𝐒 𝐏𝐑𝐎𝐅𝐈𝐋𝐄𝐃:

• Medtronic (Ireland)

• Johnson & Johnson Services, Inc. (U.S.)

• Koninklijke Philips N.V. (Netherlands)

• GE Healthcare (U.S.)

• Siemens Healthineers AG (Germany)

• Stryker (U.S.)

• Abbott (U.S.)

• BD (U.S.)

• Cardinal Health (U.S.)

𝐊𝐞𝐲 𝐅𝐚𝐜𝐭𝐨𝐫 𝐃𝐫𝐢𝐯𝐢𝐧𝐠 𝐭𝐡𝐞 𝐆𝐥𝐨𝐛𝐚𝐥 𝐌𝐞𝐝𝐢𝐜𝐚𝐥 𝐃𝐞𝐯𝐢𝐜𝐞𝐬 𝐌𝐚𝐫𝐤𝐞𝐭:

The rising prevalence of chronic diseases like cancer and diabetes, along with a growing aging population, is driving the demand for medical devices. Increased awareness initiatives, healthcare spending, and improved reimbursement policies are further boosting the adoption of diagnostic and treatment procedures globally.

𝐊𝐞𝐲 𝐅𝐚𝐜𝐭𝐨𝐫𝐬 𝐑𝐞𝐬𝐭𝐫𝐚𝐢𝐧𝐢𝐧𝐠 𝐓𝐡𝐞 𝐆𝐥𝐨𝐛𝐚𝐥 𝐌𝐞𝐝𝐢𝐜𝐚𝐥 𝐃𝐞𝐯𝐢𝐜𝐞𝐬 𝐌𝐚𝐫𝐤𝐞𝐭:

The high cost of medical devices, including acquisition, maintenance, and accessory replacements, poses a challenge to market growth. Advanced technologies like surgical robots come with significant expenses, limiting their adoption. For instance, da Vinci surgical robots cost between $1.85 million and $2.3 million, with annual maintenance reaching $125,000. Additionally, limited reimbursement policies in emerging countries further restrict access to these devices, making adoption more challenging for hospitals and surgical centers.

Latest News in Global Market:

Will US tariffs hit the medical device industry in India?

U.S. tariffs on medical devices create hurdles for India's expanding export market. AiMeD underscores the potential impact on industry growth and urges government intervention in bilateral negotiations. The exclusion of pharmaceuticals from the reciprocal tariffs imposed by the Trump administration has provided significant relief to Indian drug manufacturers, as the U.S. remains their largest market, accounting for 31.3% of total exports in 2024. However, India's medical device industry, still in its growth phase, is expected to face a substantial impact.

𝐆𝐞𝐭 𝐚 𝐐𝐮𝐨𝐭𝐞: https://www.fortunebusinessinsights.com/enquiry/get-a-quote/medical-devices-market-100085

Recent Major Developments in the Market

In January 2024, GE Healthcare announced its acquisition of MIM Software, a leading provider of medical imaging analysis and AI solutions specializing in radiation oncology, molecular radiotherapy, diagnostic imaging, and urology. Additionally, Medtronic received U.S. FDA approval for its Percept RC Deep Stimulation System, featuring advanced BrainSense technology for personalized treatment of Parkinson’s disease, epilepsy, and other conditions.

Innovations in Medical Devices

Dissolvable Pacemaker for Newborns: Researchers at Northwestern University have developed the world's smallest pacemaker, measuring just 1.8mm by 3.5mm. Designed for temporary use in newborns with congenital heart defects, this wireless device can be injected using a syringe and naturally dissolves in the body after use, eliminating the need for surgical removal.

Integration of Glucose Monitoring with Wearable Technology: DexCom has partnered with ŌURA to integrate DexCom's glucose monitoring technology with ŌURA's smart rings, which track heart rate, activity, sleep, and stress. This collaboration aims to provide users with comprehensive health data and is expected to be available in the first half of next year.

𝐑𝐞𝐥𝐚𝐭𝐞𝐝 𝐑𝐞𝐩𝐨𝐫𝐭𝐬-

Medical Adhesives Market Size, Share, & Industry Analysis

Medical Polymers Market Size, Shar,e and Forecast, 2032

Ashwin Arora

Fortune Business Insights™ Pvt. Ltd.

+ +1 833-909-2966

email us here

Visit us on social media:

Facebook

X

LinkedIn

Distribution channels: Business & Economy

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release